With the unfortunate reality of wildfires, floods and even a tsunami alert impacting various regions of Canada over the summer, emergency preparedness is no longer just an isolated concern—it’s becoming increasingly relevant to many of us. While many high-net- worth families have long planned for unexpected life events through emergency funds and insurance, short-term crises like natural disasters often require an added layer of readiness.

In a previous newsletter, we discussed the importance of an emergency fund: typically three to six months of living expenses set aside to weather unexpected challenges such as a job loss, medical emergency or home repairs. This article focuses on actions you can take now to help support physical safety and financial continuity in response to a fast-moving, adverse event.

Your Financial Readiness Checklist

Before a Crisis

- Keep cash on hand: Store $200 to $500 in smaller denominations in a waterproof container.

- Safeguard documents:

- Store printed copies of IDs, insurance, deeds and key account details in a fire/waterproof folder.

- Back up digital versions of financial documents and estate plans to encrypted cloud storage.

- Store printed copies of IDs, insurance, deeds and key account details in a fire/waterproof folder.

- Review insurance: Understand your home and auto policy coverage: What is included (e.g., flooding or evacuation-related costs)? Know your deductibles.

- Leverage technology: Download mobile apps for key financial accounts and enable alerts.

- Create a communication plan: Establish an out-of-town contact and family meeting place in case of separation. Keep a list of emergency contacts, including family, friends and professional advisors.

- Prepare for vulnerable dependents: Plan for pets, seniors, children or those with mobility/medical or other special needs.

- Have essentials ready:

- Keep your vehicle at least half full of gas (where possible).

- Maintain a three-day supply of medications.

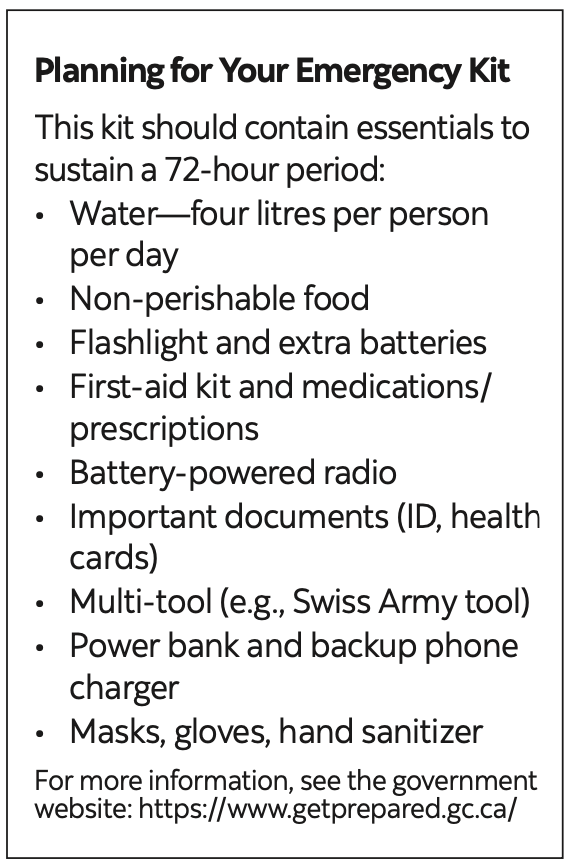

- Keep water, food and batteries stocked (see inset: “Planning for Your Emergency Kit”).

After an Adverse Event

• Document everything: Photograph and document any property damage before cleanup.

• Keep receipts for all related expenses.

• Contact financial and insurance advisors promptly to access emergency funds or initiate claims.

The Bottom Line

While no one expects a natural disaster to affect them directly, the reality is that we’re all potentially vulnerable. Taking a few simple, proactive steps today can go a long way toward reducing stress and protecting your financial security during an emergency. We certainly hope to never rely on these measures, but having a plan in place can provide critical support when it matters most. As always, I am here to help ensure your financial plans are designed to support you—both in everyday life and in the face of the unexpected.

.png)

.png)

.png)