In the current environment of slow growth and heightened geopolitical and economic uncertainty, there has been renewed attention to alternative investments.

First: A Brief Look At the Renewed Interest in Gold

After a two-year bull market run, the S&P 500 underperformed commodities like gold and silver at the start of 2025, as investors sought a “flight to safety.” A recent report from the World Gold Council suggested that demand for gold remained “insatiable” throughout 2024, hitting new record highs.1 What is driving this demand? Interestingly, global central banks have been leading the charge. The central banks of Poland, Turkey and India all made notable increases to reserves in 2024.

A Brief Background on Alternatives

Gold is a commodity and just one category of alternative investments that often attract attention during more uncertain times. Alternatives refer to assets outside of traditional bonds, stocks and cash. These can be classified into two broad categories: i) public market alternatives, such as commodities, real estate investment trusts (REITs) and infrastructure funds; and ii) private market alternatives, such as real estate, infrastructure, private equity, venture capital and private debt. Many successfully managed pension funds allocate a substantial portion of investments to alternatives, such as teh Yale Endowment and the Canada Pension Plan Investment Board,2 highlighting the growing role of alternatives in institutional portfolios.

One of the key reasons to include alternatives in a diversified portfolio is their generally low correlation with traditional asset classes like equities and fixed income. Alternatives can reduce portfolio volatility and help smooth fluctuations typically experienced in equity markets. Additionally, they can provide income from sources beyond traditional dividend and interest payments, potentially enhancing a portfolio’s risk-adjusted return. However, as with any investment, alternatives come with varying risk and return profiles. Some may be highly illiquid or involve lengthy investment time horizons, while others may lack regulatory oversight, introducing additional risks. Moreover, they can involve higher fees or more complex tax structures.

The Growth of Private Markets

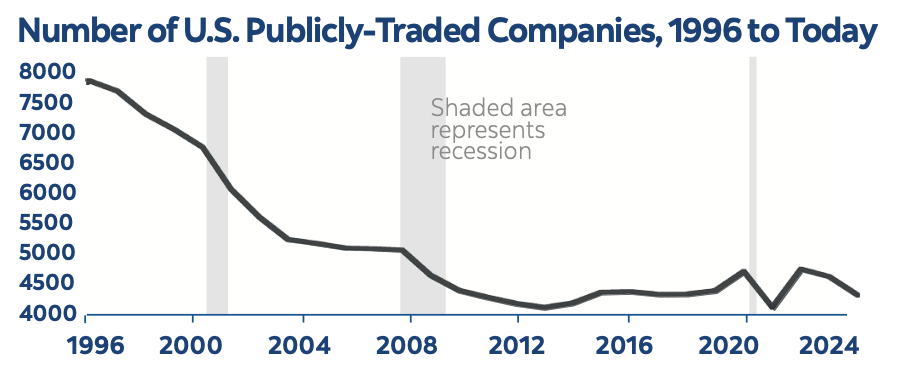

One of the more interesting developments in the alternative landscape has been the expansion of private markets at the expense of public markets. In 1996, the number of publicly-listed companies in the U.S. peaked at around 8,000. Since then, despite $20 trillion in U.S. economic growth and a population increase of 70 million people, the number of publicly-traded companies has declined to around 4,000 today (chart below).3 By one estimate, 87 percent of U.S. firms with revenues exceeding $100 million are now private.4 With many different types of alternative investments, each carrying its own strategies, risk, and reward profiles, their role in a diversified portfolio depends on an investor’s risk tolerance and objectives. If you are considering how alternatives may complement your portfolio, please call the office for a deeper discussion.

1. https://www.cnbc.com/2025/02/05/worlds-demand-for-gold-hit-another-record-high-in-2024.html;

2. Both funds have over half of their investments in alternatives: https:// investments.yale.edu/about-the-yio; https://www.cppinvestments.com/the-fund/f2024-annual-report/;

3. https://www.theatlantic.com/ideas/archive/2023/10/private-equity-publicly-traded-companies/675788/;

4. https://www.apolloacademy.com/many-more- private-firms-in-the-us/

.png)

.png)

.png)