No surprise – another week, more drama in Washington.

The U.S. government has entered its first shutdown in nearly seven years, the third under an administration led by President Trump, due to an unresolved political deadlock over federal funding. While government shutdowns are not uncommon in U.S. history (with 20 occurring since 1976), the current environment presents some unique variables investors should keep in mind.

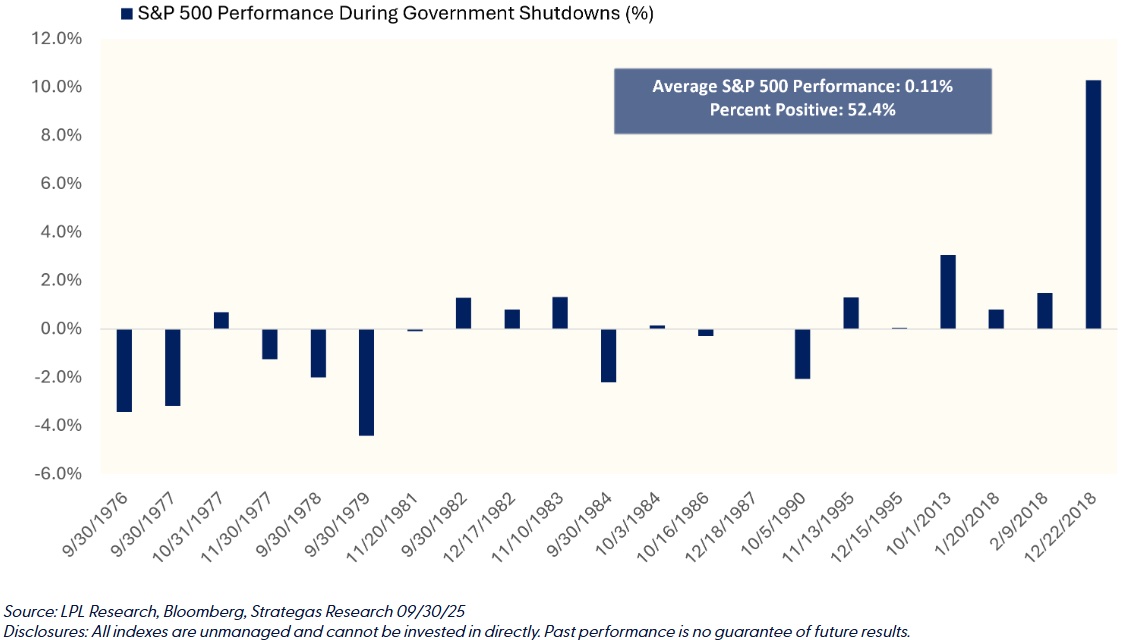

Historically, shutdowns have had limited direct impact on financial markets. In fact, during past shutdowns, the S&P 500 has often shown resilience, posting gains in several instances. For example, during the 2013 shutdown, markets rose over 3%, and during the longest shutdown in 2018–2019, the S&P 500 climbed more than 10% as attention shifted toward Federal Reserve policy changes (see chart below).

That said, each shutdown can have different consequences depending on its length, scope, and the broader economic backdrop. This time, potential delays in key economic data, like the jobs report or inflation figures, could increase market uncertainty, especially as investors watch for signals on future rate cuts. Additionally, if the shutdown is prolonged or broader in scope (including more extensive federal job cuts), the economic impact could be more significant than in past instances.

While mandatory programs like Social Security and Medicare remain operational during shutdowns, the temporary disruption to public services and federal spending could lead to short-term market volatility or shifts in investor sentiment. This is particularly true for sectors closely tied to government contracts or consumer confidence. As always, the full impact will depend on the shutdown’s duration and scope—only time will tell.

Given the ongoing political and economic uncertainty, including events like government shutdowns, it’s a good reminder of why a well-rounded investment approach matters. By diversifying portfolios across five to six asset classes, a range of sectors, and various geographic markets, we aim to help protect your wealth from short-term volatility and unexpected headwinds.

If you have any comments or questions, please don’t hesitate to reach out.

.png)

.png)

.png)